Selling

Part of my success comes from keeping you educated. You’ll be well aware of everything involved from the value of your home in the neighborhood to the complex dealings of the escrow process.

My first priority is YOU!

Selling your home involves much more than just listing it on the MLS and placing a sign in your yard. The process of spreading the word about your property is intricate and relies on a trusted expert. My marketing approach is structured into three phases: Marketing Preparation, Marketing Execution, and Marketing Conclusion. Since every property and market is unique, each marketing plan is tailored accordingly. This material provides a glimpse into the realm of what's possible in the art of marketing homes.

Market Preparation:

First, we meet to assess your property, examining features, history, and market potential. We then conduct a thorough evaluation, identifying enhancements, modifications, and cleaning needs. This informs a Comparative Market Analysis, guiding our pricing strategy for maximum exposure and competitive offers, based on recent local sales data.

Next, we create a compelling, accurate property description, ensuring it includes essential details like square footage. Preparing for photography, we may stage or declutter as needed, earning praise from our clients.

Our skilled photographers craft captivating images, and we may include multimedia like virtual tours, property websites, and floor plans to provide an immersive experience for potential buyers.

Marketing Execution:

Upon completion of these steps, we list your property on the MLS, granting access to Realtors with potential buyers. Concurrently, we create a dedicated webpage for it on our site, featuring prominently on the homepage, listings page, and its own section. Your property gains visibility on esteemed real estate websites like Realtor.com, Zillow.com, and Trulia.com, vital as 99% of buyers start their search online.

Our adept team takes promotions a step further by showcasing your property on social media platforms—Facebook, Instagram, Twitter, and more. They compile our exclusive client newsletter, linking back to the property. Additionally, physical marketing materials like flyers, door hangers, and newsletters are distributed. Collaborating with media, we secure features in news outlets. During open house events, these efforts intensify. We craft property booklets and strategically place signs in the neighborhood.

The process isn't stagnant. We follow up with agents and potential buyers, gathering feedback that informs our approach. You're kept informed through updates and activity reports. Adjustments to pricing, if needed, are discussed and implemented across our digital assets, advertising, and websites.

All of this effort sets you up to present your home in the best light and gets your property noticed by buyers and their agents. Once we get prospective buyers, we ensure that they have lender approval and proof of funds for closing costs and down payment. We represent and advise you on the presentation of all contracts by cooperating agents and negotiate the best possible price and terms for you.

Once you jump into escrow, our team makes changes in the MLS and across all websites, social media, on newsletters, and other digital platforms to reflect this status. We handle follow-up and keep you informed, after the contract has been accepted, on all lender, title, and other closing procedures, until close of escrow.

Marketing Conclusion:

Finally, we declare success and deliver your closing package, including any net proceeds to you. The active marketing of your home is done, but we are not. Once your home is sold, we again make changes on all digital platforms to show that the property is off the market.

Achieving success hinges on locating the ideal buyer.

Timing is extremely important in the real estate market. The above graph illustrates the importance of placing your property on the market at a realistic price and terms from the very beginning. A property attracts the most excitement and interest from the real estate community and potential buyers when it is first listed; therefore it has the highest chances of a sale when it is new on the market.

PRICING VS TIMING

INTELLIGENT PRICING

Pricing your property competitively will generate the most activity from agents and buyers. Pricing your property too high may make it necessary to drop the price below market value to compete with new, well priced listings.

FAQ'S

How do I determine the value of my home?

You are not the one who decides the value of your home-- the market does. Location, condition, competition, and lending/mortgage rates are all factors that determine the value of your home.

Can I still sell my home even if I have only lived there for a short period of time?

You can sell whenever you wish, but you will more than likely lose money if you buy a home and sell too quickly! The payments you make in the early part of your loan mainly go to the interest portion of your loan, not the principal. If you sell early in the process, unless you have made extra principal payments, got the home at an extremely low price, or made a large down payment, you will most likely have to bring money to the closing table in order to sell.

What should I consider when selling a home?

The most important factors are condition, price and exposure. We look for areas where we can cosmetically tweak the look of the home and add perceived value. A great example would be painting the front door to prepare for sale; you can then seek to settle on a preferred listing price. Listings rarely sell at exactly the listing price. Therefore, we view listing price really as just a marketing tool that we can manipulate to our client’s advantage. Finally, to ensure exposure the home needs to be seen: be it open houses, broker open houses or attention from marketing -- great advertising across all mediums only adds to a home's bottom line.

Should I make the repairs?

Since buyers often include a contingency “inspection clause” in the purchase contract which allows them to back out if numerous defects are found, completing minor repairs before putting the house on the market may lead to a better sales price. Once the problems are noted, buyers can attempt to negotiate repairs or lower the price with the seller. Any known problems that are not repaired must be revealed as a material defect. Part of what we offer is to help the sellers to come up with a strategy to avoid potential issues.

BUYING

I AM DEDICATED TO FINDING YOUR DREAM HOME.

BUYING A HOME INVOLVES SO MUCH MORE THAN JUST WINDOW SHOPPING ON THE INTERNET.

I AM DEDICATED TO FINDING YOUR DREAM HOME AND SEEING YOUR BEST INTERESTS ALL THE WAY THROUGH.

With my extensive brokerage experience, you’re in good heads every step of the way from the beginning searches to closing.

THE SEARCH FOR YOUR DREAM HOME SHOULDN’T BE LIMITED, THAT’S WHY I WILL CREATE ALL OF THE POSSIBILITIES FOR YOU.

Because of my strong ties and relations with other brokers and agents, I am one of the first to know about off-market properties, giving you exclusive access to homes other buyers don’t know about.

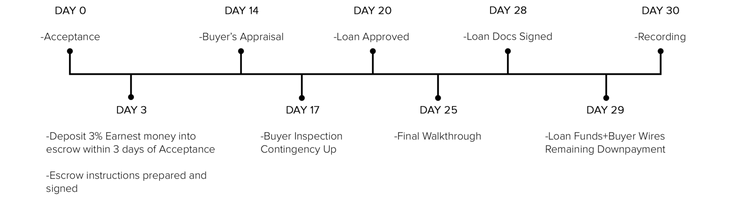

ESCROW PROCESS

FAQ'S

Do you have access to foreclosure lists?

Absolutely, and these days, the best foreclosure deals are here and gone in the first week. The public internet usually only gives access to foreclosures that are overpriced and have been sitting on the market for months. In order to find the best foreclosure deals, you need a team scouring the market for the best deals as soon as they hit the market.

Do I need a Real Estate Agent?

Real estate agents can help you narrow your housing options. The U.S. Department of Housing and Urban Development recommends the use of a real estate agent. Make sure the agent works for you so the agent will be working for your interests. Your agent can take your criteria for a home, including cost, neighborhood, schools, home size and amenities, and match it with the Multiple Listing Service (MLS), which lists all of the homes for sale in a particular area. If you’re purchasing government housing, such as a HUD home, you must have an agent. Remember, finding the property is the least of what an agent does, especially with the internet. Having a good negotiator on your side can still make or break a deal, and is the most important part of getting a “good deal”. This is why it is still so crucial to choose your agent early in the process. You should choose an agent that you believe can negotiate well on any property of interest.

What are lender fees and what should I expect?

Lender fees can range from .5% to 1.5% percent of the purchase price, depending on the rate and program that the buyer is choosing. The buyer usually has options available that can secure him a lower lender fee in exchange for a higher interest rate, and vice-versa.

What is a down payment, and do I need to send this money in right when my offer is accepted?

You are responsible for two upfront costs when you buy a home. First, there is earnest money, which is a small deposit that lets the seller know you’re serious about buying the home. Earnest money can be usually anywhere up to the 3% of the purchase price (eventually going towards your down payment). The second is the down payment, which is a percentage of the cost of the home, that doesn’t need to be sent to escrow until 2 days after closing. Lenders have different requirements for down payments. Traditional lenders usually seek a down payment of at least 10%. Lenders backed by the government can seek less, if you qualify. FHA has a program where you are only required to make a 3% down payment.

What Happens at Closing?

Closing is when you sign all of the loan and ownership paperwork and take over the home. At closing you will be responsible for taking care of some costs, including lender's title policy and points to lower the interest rate on your mortgage, along with fees for loan origination, loan applications, appraisals, housing surveys and even your first month of homeowner’s insurance. These costs can be around 1 - 1.25%, and are largely costs related to obtaining your loan. In addition, please remember that during the inspection period, you will also need to additionally budget to pay for the inspectors you hire. A general inspection costs around $400 and a budget of $1500 for inspection costs is general a good rule of thumb.